Background/Scenario

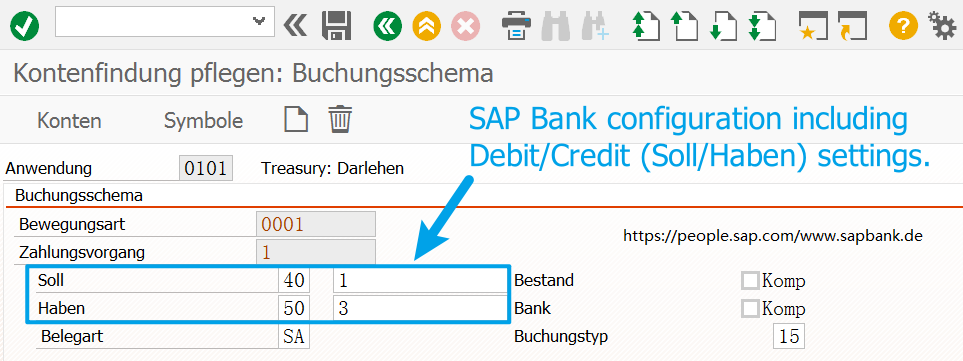

IFRS9 implemented in 2018 has further changed the old bank accounting classification and measurement rules. By SAP Bank project implementations, we need to setup debit/credit settings for Loans Management, Collateral Management, Bank Customer Account, Business Partner, etc. The concept debit/credit, in German Soll/Haben, in Chinese and in Japanese, 借方/贷方 or 借方/貸方, is important for our configuration.

We are aware, the bank accounting is quite different from general enterprise accounting; and SAP Bank solution represents accounting rules in the real world. This article tries to clarify and provide an easy approach to catch the concept of debit/credit and will help us to understand/remember bank accounting entry rules, especially those after 2018.

Although This introduction is focusing on bank accounting entries under IFRS9 structure, it could help to understand bank accounting treatment and entries before IFRS9 as well.

Note: IFRS9: International Financial Reporting Standard 9 Financial Instruments. https://www.ifrs.org/issued-standards/list-of-standards/ifrs-9-financial-instruments/#translations

Three steps to catch the concept

Step One: remember

Assets = Liabilities + Equity

Step Two:

Assets = Liabilities + Capital + Revenues – Expenses – Dividends

Step Three: Expand the above equation under IFRS9

The left side of the equal sign = Cash + central bank balances + Interbank balances without central bank items + Central bank funds sold and securities purchased under resale agreements + Securities borrowed + Total financial assets at fair value through profit or loss + Fair value through other comprehensive income + Financial assets available for sale + Equity method investments + Loans at amortized cost + Securities held to maturity + Property and equipment + (Account and notes receivable – Allowance for doubtful accounts) + Inventory + Land + (Buildings or equipment & tools – accumulated amortization of buildings or equipment & tools) + Goodwill and other intangible assets + Other assets + Assets for current tax + Deferred tax assets.

The right side of the equal sign = Deposits + Central bank funds purchased and securities sold under repurchase agreements + Securities loaned + Financial liabilities at fair value through profit or loss + Other short-term borrowings + Other liabilities + Provisions + Liabilities for current tax + Deferred tax liabilities + Tier 1 capital items + Supplementary capital items as undisclosed reserves or subordinated debt + Trust preferred securities + (Revenues of Corporate Bank Global Transaction Banking and Commercial Banking – Expenses of Corporate Bank Global Transaction Banking and Commercial Banking) + (Revenues of Currency and Fixed Income Certificate Sales & Investment Bank Trading – Expenses of Currency and Fixed Income Certificate Sales & Investment Bank Trading) + (Revenues of Origination & Advisory – Expenses of Origination & Advisory) + (Revenue of Core Banking – Expenses of Core Banking) + (Revenues of other bank business segments like Private Bank or Asset Management – Expenses of other bank business segments like Private Bank or Asset Management) + (other Interest income – other Interest expense) + (other Commission and fee income like – other Commission and fee expense) + other Remaining income – Cash Dividends – Stock Dividends.

Note: 1. a bank’s balance sheet does not contain enterprise inventories, but I would keep it there; 2. “Other assets” before “Assets for current tax”, “Deferred tax assets”; 3. the equation as a high-level structure could be further expanded.

So now read the above equation in step 3 again and we concentrate on the signals +/–. Sure, just like we read ABAP, you might skip a complete function module —- the step 3 —- we can read further now and get back to step 3.

Then the know-how:

For bank accounting, we just remember:

Debit-Soll-借方-借方:

Anything on the left side of the equation with “+”, increasing.

Credit-Haben-贷方-貸方:

Anything on the right side of the equation with “+”, increasing.

Conclusion

Besides the rules above, we could use the equation in daily SAP Banking configuration:

1. Anything on the left side with “–”, increasing, write it to Credit-Haben;

2. Anything on the right side with “–”, increasing, write it to Debit-Soll;

3. Anything on the left side with “+”, decreasing, write it to Credit-Haben;

4. Anything on the right side with “+”, decreasing, write it to Debit-Soll.

5. In double-entry accounting, there is no negative item in accounting entries.

The rule above could help us to understand/remember the principles of bank accounting under IFRS9 and help us to fix accounting settings in SAP Bank modules: BCA, Loans, Collateral Management, etc.

Hope you like this simple and effective approach!

- Log in to post comments