Article

SAP TechEd 2020 follow-up 2-hour Sessions: Live & free & zero waitlist

Many attendees of TechEd 2020 provided feedback that the registration of 2-hour sessions in TechEd 2020 had been that difficult... Waitlist too long. Now, as part of SAP TechEd 2020 follow-up events, SAP is holding some “live sessions” in the coming days!

If you are interested in this, do not miss this chance: you may search them in SAP Learning Hub. Here, I selected some of them, which are relevant to HANA Cloud and might be relevant for function consultants as well.

Cloud Platform Integration & Business Application Studio Introduction: Concept & Demo

This article---- an introduction to SAP HANA Cloud Platform ---- has 9 parts:

- Four parts regarding SAP Cloud Platform Integration (the successor of XI/PI/PO, released in March-December 2020);

- Five parts regarding SAP Business Application Studio (a cloud IDE, released in Dec. 2019/Q1 2020).

Here is an overview of these 9 parts. For more details, may refer to the links below.

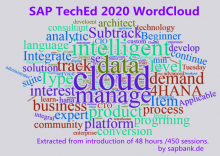

SAP TechEd 2020 coming! And its wordcloud from 48h/450 sessions.

SAP TechEd 2020 starts in just a couple of hours, we can visit the event with registration at:

https://pages.sapteched.com/sap/sapteched2020/index

or, without registration at Channel 1 stream broadcast with Twitter Live Event

Overview of New Features of SAP Bank: S/4HANA 1610/1709/1809/1909/2020 and Outlook to Future (Part Four): Future outlook: the coming decade for SAP Bank

Outlook to the coming decade, three trends of SAP Bank / Banking Services from SAP are in expectation.

1. SAP Bank should transform into a more easy-to-use software. This means the interaction between users and the software becomes more like the interaction between a user and his intelligent assistant, even it appears to be non-logical and non-database software, although certainly it is logical and based on database.

Overview of New Features of SAP Bank: S/4HANA 1610/1709/1809/1909/2020 and Outlook to Future (Part Three): Flexible and easier customization and reporting: SAP Bank implementation is faster than ever

SAP Bank becomes more flexible for customization than ever, this could be reflected through many new BAdIs in IMG. Here some examples. SAP Banking ---- Loans Management ---- BAdIs for Enterprise Services ----- BAdIs for Business Object LoanContract:

Overview of New Features of SAP Bank: S/4HANA 1610/1709/1809/1909/2020: and Outlook to Future (Part Two): Loans decision-making becomes more intelligent: SAP Bank with machine learning

SAP introduced “intelligent loans management” in S/4HANA, with this step SAP Bank becomes more intelligent than ever. New customization itemss in S4H 1909 shows SAP is trying to build an “intelligent bank” (The Intelligent Enterprise for the Banking Industry). In the S/4HANA 1909 easy access menu, SAP introduced the following two transactions in the folder “intelligent loans management”.

Hedge accounting: two main scenarios and their accounting entries respectively

1. Definition, regulation and business approach

Definition of hedge accounting

A hedge accounting means designating one or more hedging instruments so that their change in fair value offsets the change in fair value or the change in cash flows of a hedged item.

Regulations on hedge accounting in Germany

HGB §254 Bildung von Bewertungseinheiten; Bilanzrechtsmodernisierungsgesetz (BilMoG)

International financial reporting standard (IFRS) 9 Financial Instruments.

Typical balance sheet and revenue structure of bank accounting under IFRS9

A typical bank balance sheet and revenue structure in IFRS9. Items marked with “xx” are recommended by me as key items: by reading reports of a bank, might pay more attention on the detailed structure of these items.

Overview of New Features of SAP Bank: S/4HANA 1610/1709/1809/1909/2020 and Outlook to Future (Part One): Stronger integration with other modules: Banking concept goes beyond banking

Background

This article tries to provide a overview of the new features of Banking Services from SAP during the past five years — 2016 till 2020 — in S/4HANA 1610/1709/1809/1909/2020 as well in specific banking modules, with comments on its outlook. Overview is organized from the viewpoint of system characteristics or the development trends, not by timeline from year to year, nor by function modules. In this article, “Banking Services from SAP”, “SAP Banking”, and “SAP Bank” these three concepts are equivalent and can be used interchangeably.

Basel III Framework High-level Overview updated in Nov 2020

Basel III Framework High-level Overview

Basel III Requirements in 2021: SA–CCR Calculation Structure and its SAP Bank Solution

Background

As a part of Basel III, SA–CCR will be fully effective in June 2021, and it has been implemented or is being implemented in some medium-sized and large banks, which are among target clients of SAP Bank Solutions. SA–CCR calculation is relative complicated: from SDL till report it takes about ten layers. This article tries to provide an overview of the SA–CCR structure in a single picture. Note: the main content of this article is the second picture in this article. If you just want to understand SA-CCR structure, can just read that picture and ignore the text.

Three steps to catch the concept debit/credit or Soll/Haben in bank accounting entries under IFRS9

Background/Scenario

IFRS9 implemented in 2018 has further changed the old bank accounting classification and measurement rules. By SAP Bank project implementations, we need to setup debit/credit settings for Loans Management, Collateral Management, Bank Customer Account, Business Partner, etc. The concept debit/credit, in German Soll/Haben, in Chinese and in Japanese, 借方/贷方 or 借方/貸方, is important for our configuration.