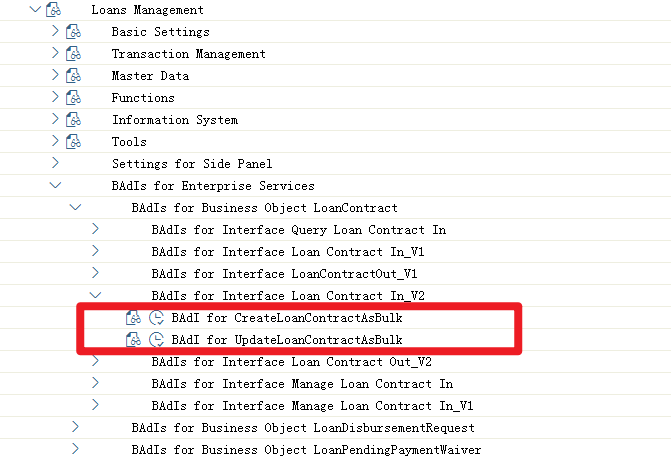

SAP Bank becomes more flexible for customization than ever, this could be reflected through many new BAdIs in IMG. Here some examples. SAP Banking ---- Loans Management ---- BAdIs for Enterprise Services ----- BAdIs for Business Object LoanContract:

- BAdIs for Interface Loan Contract In_V2

- BAdI for CreateLoanContractAsBulk

Some of these BAdIs are based on requirements from different clients. Principally, many of these new SAP Bank BAdIs serve as a “Bridge” which links the SAP Bank solution (“this” application) to other applications or UX, which are usually based on web services. Through these new BAdIs, SAP simplifies the implementation and customization.

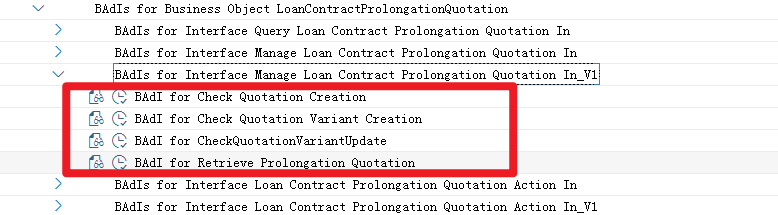

For example, BAdI: check quotation creation could be implemented in following steps:

- An incoming message A.

- Other validations (as usually) check message A, say regular expression verifications, fields check, etc. by other non-SAP modules.

- Call this BAdI, the method “VALIDATE”, so SAP provides standard validations here. And at this step, customization could define other specific validations. Especially, could check keys and fields dependencies at this step.

- After the validation, process a relevant mapping. A mapping is map message A to this application (the SAP application). Typically with an API.

- Call of the BAdI method MAPEXT2INT. This step is the second conversion level: to modify the mapping result of step 4.

- Executing the business logic.

- If necessary, call of the BAdI method CALL_CUSTOMER_FUNCTION, this is a complement to the previous step.

- Mapping back. (APIs for mapping from the internal format of this application to external Web Service.)

- Call of the BAdI method MAPINT2EXT, similar to step 5, step 9 could modify the mapping of step 8. Standard settings.

And more new BAdIs available in S4H 1909:

Use SE18 and SE19 for BAdIs, especially the standard settings (filters, single or multiple uses), the “Enhancement Spot Element Definitions” tab in the BAdI Builder (SE18). The interface in the Class Builder could be maintained through SE24.

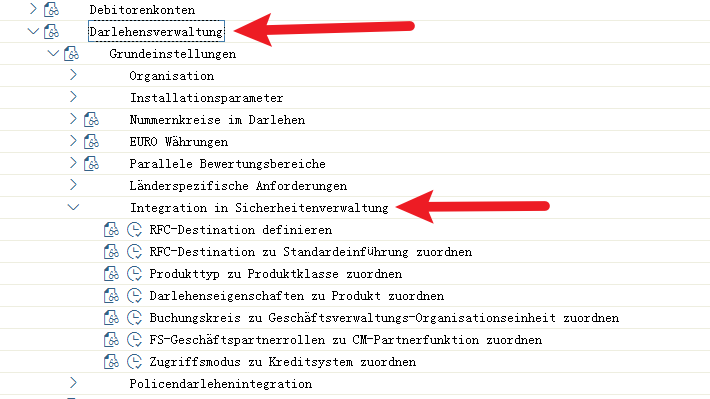

Customization structure becomes easier to follow, e.g. new CMS Customization structure in CML

Some CMS Customization officially moved from CMS to CML, e.g.:

- Map Product Category to Product Class

- Map Loan Attributes to Product

- Map Company Code to Receivable Organizational Unit

- Map FS Business Partner Roles to CM Partner Function

Why SAP makes this change in S4HANA 1909? This makes its IMG structure clear: more straightforward and easier to understand. If you just focus on CML may feel the change is not that obvious, but if you have a look at CMS, it IMG structure becomes much better than in ECC or R3: Here are some of the most important IMG settings for CMS in S4Hana 1909. This IMG menu gives a clear business sense.

New Enterprise Services make SAP Bank implementation easier, Loans module as an example:

Loan Contract Prolongation Quotation Action In_V1 (service interface)

o Check Quotation Acceptance

o Calculate Quotation Variant

o Check Quotation Variant Rejection

o Check Quotation Rejection

o Check Quotation Cancellation

Loan Contract Prolongation Quotation In_V1 (service interface)

o Create Quotation as Bulk

o Create Quotation Variant as Bulk

o Update Quotation Variant as Bulk

o Accept Quotation as Bulk

o Reject Quotation as Bulk

o Reject Quotation Variant as Bulk

o Cancel Quotation as Bulk

The full new enterprises services are much more this, here just an example. Most of these new services are summarized from business practice and requirements of SAP clients worldwide.

New Core Data Services (CDS) Views for SAP Bank

CDS (Core Data Services in this paper, not confused with Credit Default Swaps in SAP Bank Analyzer) is an infrastructure that can be used by database developers to create the underlying (persistent) data model which the application services expose to UI clients. SAP S/4HANA edition provides quite a lot of new CDS views for further development, especially in SAP Loans. The concept of CDS is that it is a “view” so it does not directly process the bank business, but it makes users easier to create a table as an entity, create SQL views, create associations between entities or views, and create user-defined structured types. I will demo in another paper, how to handle CDS in HANA Studio: from install, connection, created a development workspace and a project, till define and utilize CDS.

Here are some of the new CDS in Loans module, both View and Technical Name:

o Loan Class, I_LoanClass

o Loan Contract Notice Type, I_LoanContractNoticeType

o Loan Correspondence Role Type, I_LoanCorrespncRoleType

o Loan Type, I_LoanType

o Loan Term, I_LoanTerm

o Loan Security Type, I_LoanSecurityType

o Loan Sales Region, I_LoanSalesRegion

o And many other CDS

CDS makes SAP Bank become stronger, as well makes us easier to fulfill the increasingly complicated requirements of risk managment, especially from the authority / Basel III.

- Log in to post comments