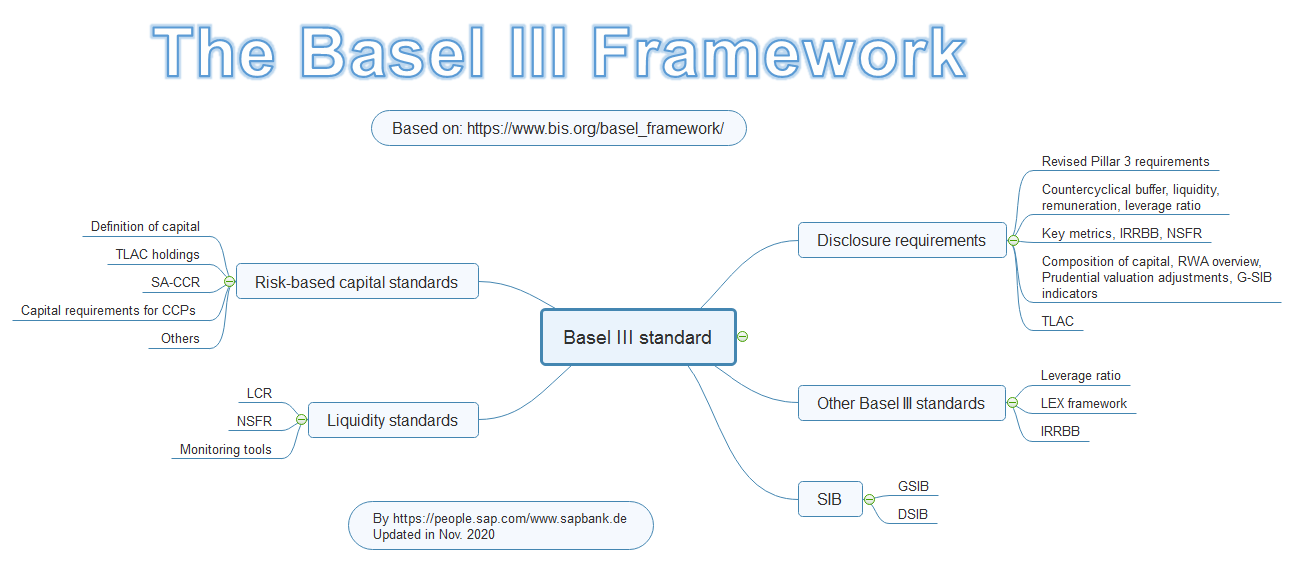

Basel III Framework High-level Overview

We always hear about “Basel III”, but what is its structure? This short article tries to give you a high-level overview of Basel III, especially for consultant of SAP Bank Analyzer, BI. etc. By implementing SAP Bank Analyzer for Risk Management, we need a clear overview of the structure. For example you are customizing Basic Settings —-> Assignments —-> Assignments to Default Risk Rule —-> Assign Risk Sensitivities in Credit Risk Analyzer. Then, an understanding of the whole picture will help you to better understand this Risk sensitivities setting should be and also possibly will be reused in other relevant modules, such as stress test settings (not confused with SAP performance stress test, here it refers to Basel III stress test, which is supervised by EBA and carried out by Bundesbank in Germany). So I summarized this introduction and prepared the overview picture, based on: https://www.bis.org/basel_framework/ which was last updated in Nov. 2020. For more information regarding SAP solution, may read: https://help.sap.com/doc/abf8ebe023bc47ecabfd32dd14d62575/9.09/en-US/BankAnalyzer_EN.pdf

Basel III Framework Overview

To keep this article concise and clear, I might not explain these concepts listed here and also might not explain their customizations in SAP Bank Modules.

Basel III framework includes:

Risk-based capital standards

- Definition of capital

- Capital conservation buffer

- Countercyclical buffer

- TLAC holdings, Total loss-absorbing capacity

- Capital requirements for equity investments in funds

- SA-CCR, The standardised approach for measuring counterparty credit risk

- Securitisation framework

- Margin requirements for non-centrally cleared derivatives

- Capital requirements for CCPs, Central Counterparties (CCPs)

Liquidity standards

- LCR, Liquidity Coverage Ratio

- NSFR, Net Stable Funding Ratio

- Monitoring tools for intraday liquidity management

Disclosure requirements

- Countercyclical buffer

- Liquidity, remuneration, leverage ratio

- Key metrics, IRRBB, Interest rate risk in the banking book, NSFR, Net Stable Funding Ratio

- Composition of capital, RWA, Risk-weighted asset, Prudential valuation adjustments, G-SIB indicators

- TLAC, Total loss-absorbing capacity

SIB

- G-SIB requirements, global systemically important banks

- D-SIB requirements, domestic systemically important banks

Others

- Leverage ratio

- LEX framework, Basel Large Exposure

- IRRBB, Interest rate risk in the banking book

Conclusion:

1. Basel III framework has five parts, as above. 2. The concept “Basel III” is actually a changing concept. 3. The current (2020) framework will keep relatively stable till end 2021. In 2022 and 2023 some new regulations will be implemented by BIS. For SAP Bank solutions, esp. Bank Analyzer and BI BAdIs, CDSs, APIs, we need to catch up with the changes and consider about coming policies.

- Log in to post comments