Background

As a part of Basel III, SA–CCR will be fully effective in June 2021, and it has been implemented or is being implemented in some medium-sized and large banks, which are among target clients of SAP Bank Solutions. SA–CCR calculation is relative complicated: from SDL till report it takes about ten layers. This article tries to provide an overview of the SA–CCR structure in a single picture. Note: the main content of this article is the second picture in this article. If you just want to understand SA-CCR structure, can just read that picture and ignore the text.

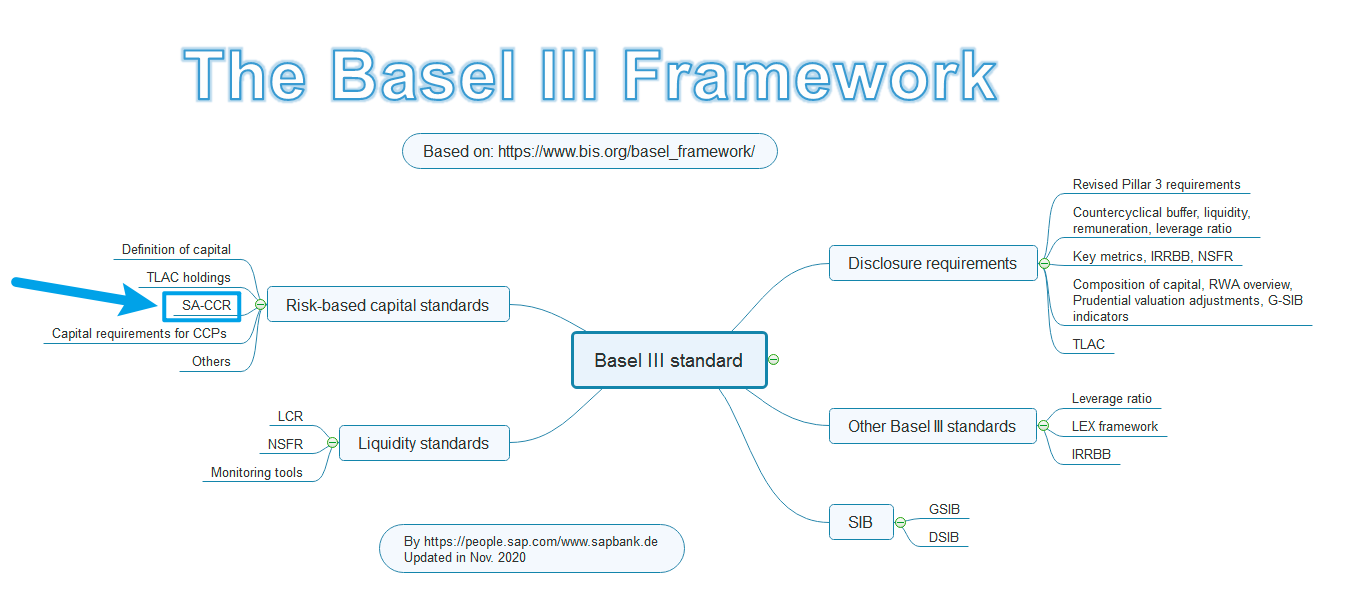

Regarding an overview of Basel III, may read my article: Basel III Framework High-level Overview, updated in Nov 2020

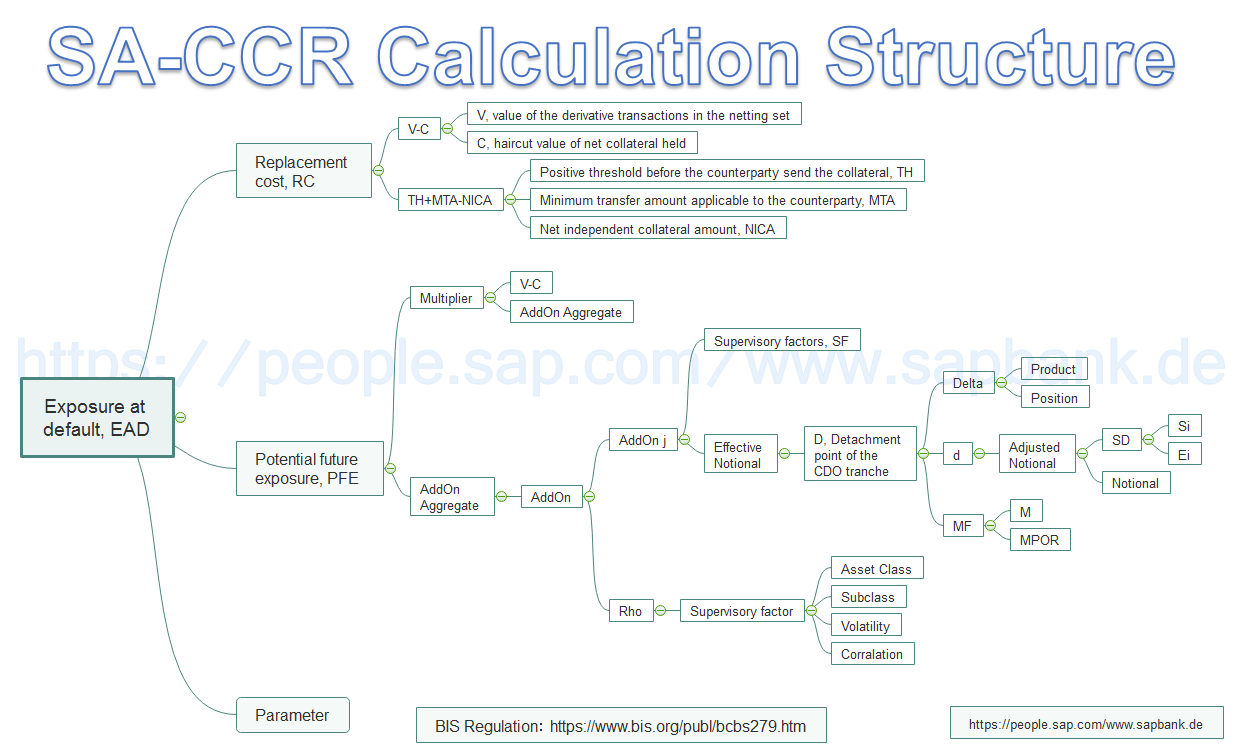

Basel III SA–CCR Calculation Structure

The SA-CCR structure, based on BIS regulation:

SA-CCR Solution in SAP Bank

Customizing of SA-CCR in Bank Analyzer (FS-BA) in SAP ECC.

Bank Analyzer (FS-BA) —- Processes and Methods —- Credit Risk —- Credit Exposure:

- Settings for Basel II —- Edit Supervisory Factors for Standardized Approach for CCR

- Settings for Basel II —- Edit Bank-Internal Process Parameters (Germany and EU)

- Settings for Basel II —- Edit Localization Parameters

- Settings for Basel II —- Edit Risk Weight

- Calculation —- Define Calculation Methods

- Calculation —- Assign Modules to Calculation Methods

Bank Analyzer should be installed before HANA upgrade. The above customization IMG is not available in S/4 default IMG. In case you know how to show Bank Analyzer IMG in S/4, plz kindly let me know. Thank you so much.

SAP provides Key Figures, Characteristics, and SDL for SA-CCR and Credit Exposure. As a reference here we have some of them (by Nov. 2020):

Key Figures and description

- &62ADAGG SA-CCR Aggregated Add-On Amount

- &62ADDCOM Add-On Amount for SA-CCR Asset Class “Commodity”

- &62ADDCRE Add-On Amount for SA-CCR Asset Class “Credit”

- &62ADDEQU Add-On Amount for SA-CCR Asset Class “Equity”

- &62ADDFX Add-On Amount for SA-CCR Asset Class “Currency”

- &62ADINT Add-On Amount for SA-CCR Asset Class “Interest Rate”

- &62ANCRE Adjusted Notional for Credit Derivatives for SA-CCR

Characteristics and description

- /BA1/C62ACLCRE SA-CCR Asset Class: Credit

- /BA1/C62ACLEQU SA-CCR Asset Class: Equity

- /BA1/C62CCRSUB SA-CCR Subclass

- /BA1/C62DELCAT SA-CCR Supervisory Delta Category

SDL Fields, Description

- /BA1/C62ACLCRE SA-CCR Asset Class: Credit

- /BA1/C62ACLINT SA-CCR Asset Class: Interest Rate

The picture above also represents the IMG configuration route map for SA-CCR in ECC Bank Analyzer.

BIS Regulation: https://www.bis.org/publ/bcbs279.htm

- Log in to post comments