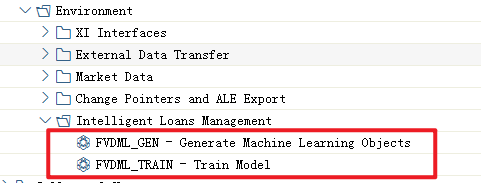

SAP introduced “intelligent loans management” in S/4HANA, with this step SAP Bank becomes more intelligent than ever. New customization itemss in S4H 1909 shows SAP is trying to build an “intelligent bank” (The Intelligent Enterprise for the Banking Industry). In the S/4HANA 1909 easy access menu, SAP introduced the following two transactions in the folder “intelligent loans management”.

We may pay attention to these new IMG in S4HANA 1909, relevant to current SAP bank solution intelligence:

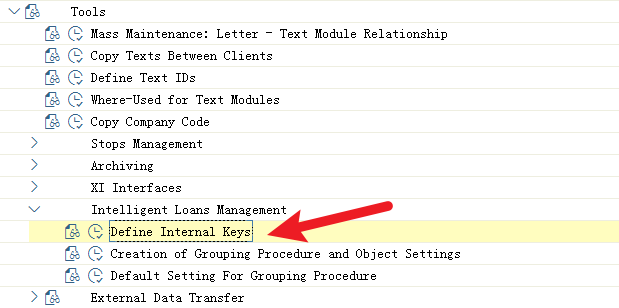

● SAP Banking ---- Loans Management ---- Tools ----- Intelligent Loans Management:

These 3 customization steps are connected, let me explain its logic as below:

○ Define Internal Keys

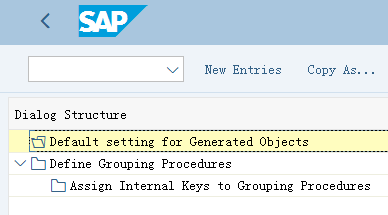

By “Define Internal Keys” actually you could define any key as in new indicator, which means certain characteristics of the BP. The next step:

○ Creation of Grouping Procedure and Object Settings

This step would assign the internal keys in the first step to grouping procedures. The grouping procedures is an important tool introduced by SAP into S4H 1909 to enhance its machine learning ability: In this Customizing activity, you can define grouping procedures to group together the main settings of the grouping procedure that is driven by machine learning. You can also assign internal keys to the grouping procedures. This enables you to generate machine learning objects and train the data model for creating more individual rollover offers.

The IMG customization logic for SAP Loan Management to make it more intelligent:

1. Customize internal keys, say you have 4 keys

2. Define grouping procedures, say you have 3 procedures

3. Assign keys to procedures, so you get a matrix of key and procedures, say 10 different groups

4. Generate machine learning objects with your matrix, say these 10 groups. The data model will be more intelligent to draw business decisions for loans case by case, say the rollover decision of a specific customer, and this is driven --- not like ECC or R/3 --- by machine learning.

○ Default Setting For Grouping Procedure

Here to assign the default currency, exchange rate type, and rating procedure for each group procedure. Although not documented directly in IMG (SAP is using the title “Intelligent LM” in IMG), this customization is still focusing on rollover. ○ Creation of Grouping Procedure and Object Settings.

The definition of grouping procedures is client-independent because client-independent ABAP artifacts are created for each grouping procedure. You can define the following for each grouping procedure: Characteristics such as the following: Academic title, Occupation, Date of birth, Credit standing, Employment status. SAP recommends that limit this to fewer than 10 to ensure good performance by the clustering algorithm.

Datasets for training (creation of a grouping model). It is recommend that you keep the number to a minimum for creating a data model in the training. The number of different groups and assignment of one rollover table to each group to enable the creation of a rollover offer. You can, for example, create four groups (must more than one): Excellent borrowers, Good borrowers, Mediocre borrowers, Poor borrowers

The reason behind these changes is the effort of SAP to become more connected and more intelligent. For this purpose, SAP has taken several strategic actions over the past decade.

The SAP efforts to build up HANA is still in progress: some SAP Bank functions not included in S4H 1909 yet, e.g. CML-specific functions with regard to collaterals and collateral objects

SAP tries to reorganize and include all key modules and functions in one suite, but in HANA 1909, some SAP Bank modules are not included yet. Even in S/4HANA 2020 in Oct. 2020.

FS-CML Consumer and Mortgage Loans: The CML-specific functions with regard to collaterals and collateral objects are NOT available in SAP S/4HANA 1909 or 2020.

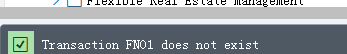

Some transactions that are fundamental for CMS collateral management in R/3 and ECC are not included in HANA 1909 or 2020, for example FN01, FN02, FN05, FN61, FN62. The Message for FN01: For such functions, the solution is the configuration and customizing in FS-CMS. Check SAP Note 2369934 for reference. Besides these, actually S4HANA new IMG focuses on automatic and intelligent processing. By searching “AsBulk” you will find many new BAdIs aiming at big data processing in SAP Bank.

- Log in to post comments